- Payroll for small businesses are changing in 2024 – learn about the newest tech tools.

- Follow the latest rules to avoid fines and keep your business compliant.

- Connect and streamline your system for better speed and easier updates.

Payroll Management: A Critical Element for Small Businesses

Efficient payroll for small businesses isn’t just a perk—it’s vital. Paying employees accurately and on time shows you’re reliable and value your team. In 2024, payroll management will rapidly change due to new technology and evolving regulations.

Adapting to Change: How Technological Advancements Are Reshaping Payroll for Small Businesses in 2024

The adoption rates of different technologies in the United States, including cloud-based solutions, mobile applications, and integrated systems, have seen significant growth over recent years.

This trend underscores the broader digital transformation in wage management, driven by the need for efficiency, flexibility, and enhanced employee experience.

Cloud-Based Software Adoption

- The cloud-based software market is projected to grow at a Compound Annual Growth Rate (CAGR) of 10% and reach a valuation of around USD 13 billion by 2031[1].

- In 2023, 62% of companies reported using cloud systems, an increase from 34.8% in 2019.

Mobile Applications

- The adoption of mobile applications for HR functions is accelerating. For instance, in a study by the ADP Research Institute, 37% of registered mobile users accessed their pay information compared to 23% of registered stationary web users, which is a 60% greater engagement rate with mobile applications[2].

Integrated Systems

- Integrated Payroll Services (IPS) experienced more than 20% year-over-year revenue growth after providing a comprehensive HCM solution on a single platform.

- IPS has maintained a 97% client retention rate since licensing the UKG® solution[3].

General Technology Trends

- The HR software market, is expected to reach USD 33.57 billion by 2028, growing from USD 15.59 billion in 2020, which indicates a 10% growth rate.

- 29% of businesses are using a wage distribution system that is ten years old or older, suggesting that there is still a significant market for newer, more advanced systems.

- Outsourcing can save businesses 18% compared to companies handling wages.

Wage services management in 2024 is getting a tech makeover. Small businesses now have innovative cloud-based solutions that offer flexibility and scalability. These advancements simplify salary processing and ensure business owners can manage their finances seamlessly anywhere.

Key Trends for Small Businesses in 2024

Focusing on these trends will help small businesses in 2024 navigate pay management more effectively.

- Adopt Cloud-Based Solutions: They offer flexibility and simplify scaling.

- Ensure Compliance: Following regulations is crucial to avoid fines.

- Integrate and Mobilize: Unified business management systems and mobile apps save time and offer freedom.

Cloud-based payroll solutions are gaining ground among small businesses in 2024 thanks to their flexibility and scalability.

These platforms allow businesses to manage wages effortlessly, adapting to growth without significant infrastructure investment. Moreover, it integrates compensation systems with other HR and accounting software streams of business management.

This unified approach ensures that data flows seamlessly between systems, reducing manual entry errors and saving valuable time.

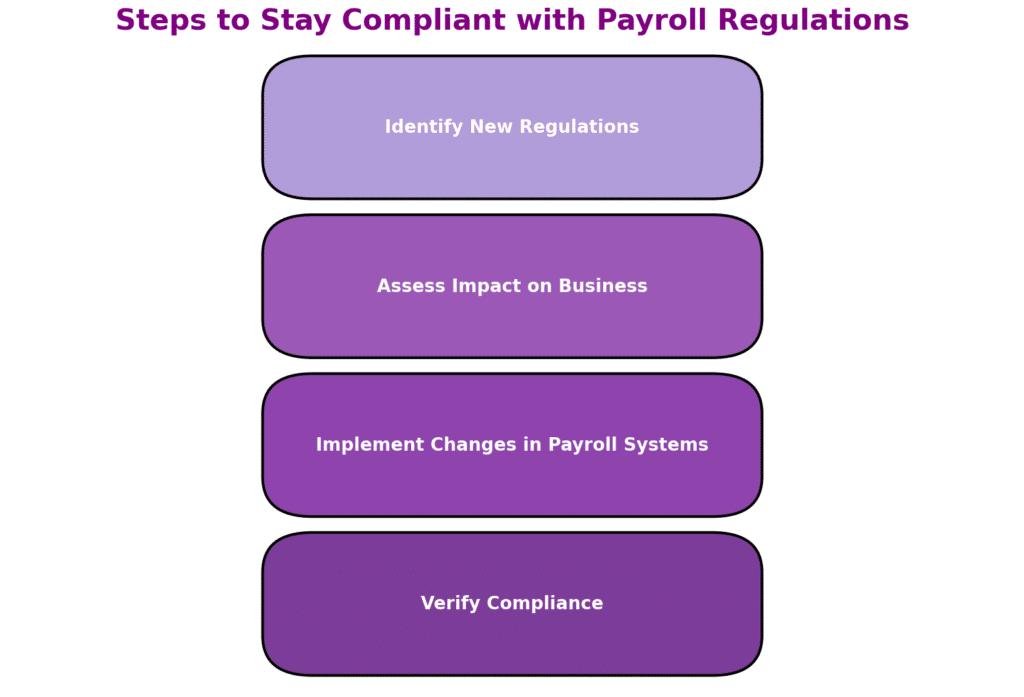

Conversely, compliance with local and federal regulations has become a pivotal focus for small businesses. With laws and tax codes constantly evolving, staying compliant helps avoid costly penalties.

Additionally, the rise of mobile applications is revolutionizing how businesses handle earnings distribution. Managing salary services on the go is a possibility and a reality, offering unprecedented flexibility for business owners and their teams.

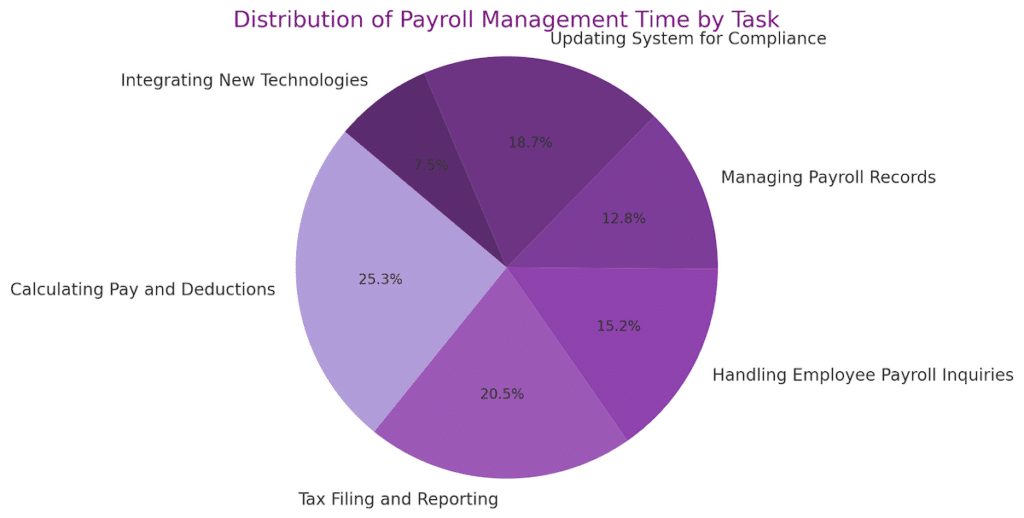

Challenges Faced by Small Businesses

| Management Challenges | Solutions for Small Businesses | Benefits of Implementing Solutions |

| Navigating complex tax codes and regulations | Stay updated with real-time services | Avoid penalties and ensure compliance |

| Managing salaries for a remote or hybrid workforce | Adopt flexible and mobile services | Accommodate diverse workforce needs and enhance accessibility |

| Ensuring data security and privacy | Implement robust cybersecurity measures | Protect sensitive information and build employee trust |

| Adapting to rapid technological advancements | Continuously educate and train on new services technologies | Stay competitive and improve efficiency |

- Stay Vigilant on Tax Codes: Understanding and compliance are key to avoiding fines.

- Adapt to Workforce Needs: Remote and hybrid models require flexible management.

- Prioritize Security: Protecting data safeguards employee trust.

Small businesses often need help with complex tax codes and regulations. Keeping up can feel like navigating a labyrinth, with each wrong turn leading to potential penalties in managing earnings.

Adding to the challenge is managing payments for a remote or hybrid workforce. This new normal demands flexibility and a keen understanding of various jurisdictions’ laws.

Data security and privacy in income processes also top the list of concerns. Protecting sensitive employee information is paramount in an age of cyber threats.

Despite these hurdles, small businesses are finding innovative ways to tackle pay management challenges head-on.

They’re adopting tools and practices in paycheck disbursement that safeguard data, ensure compliance, and support the diverse needs of their teams. The road may be tough, but it is rewarding for those who navigate it wisely.

Mastering these challenges is essential for small businesses aiming to streamline their processes effectively.

Solutions and Best Practices

The right system can make or break a small business’s financial operations. The key is to find a solution that aligns with your business needs and goals.

- Choose the Right System: Select a system that fits your business needs.

- Embrace Cloud-Based Services: Utilize cloud-based services for enhanced efficiency and security.

- Integrate Your Systems: Streamline operations by integrating payments with other business software.

A good starting point is to explore the options and insights in the article Choosing a POS System. This guide offers valuable advice on choosing a system that effectively handles requirements.

Cloud-based services are revolutionizing how small businesses handle their finances. These services offer significant benefits, from reducing paperwork to improving access to data.

Small businesses can learn more about the advantages and benefits of POS systems. Adopting cloud-based solutions simplifies processes and enhances data security and compliance.

Integrating with other business systems can streamline operations and improve efficiency. The Guide to Point of Sale Systems with Examples provides tips for seamless integration. It allows for a holistic view of business finances, making managing budgets and making informed decisions easier.

Success Story: Streamlining Payroll at Raj’s Convenience Store

Raj Patel, owner of a thriving convenience store (featured photo), made a game-changing move by switching to a cloud-based system. “With this update, my hassles halved and errors dropped to zero.” says Patel. His team now enjoys on-time, accurate paychecks, boosting their work spirit. The new system, integrated with Raj’s business operations, lets him make smarter financial decisions. This shift saved Raj time and money and set his store apart as an efficiency and employee satisfaction model.

Key Strategies

In conclusion, navigating wage compensation for small businesses in 2024 involves embracing technological advancements, ensuring regulatory compliance, and adopting best practices tailored to individual business needs.

The shift towards cloud-based solutions and integrating it with other business systems represent significant steps forward, enabling small businesses to manage their pay more efficiently and securely.

- Embrace Technological Innovations: Adopt cloud-based solutions to enhance flexibility, scalability, and data security.

- Stay Ahead of Regulatory Changes: Regularly update your knowledge of tax codes and employment laws to ensure compliance and avoid penalties.

- Integrate with Business Systems: Streamline your operations by connecting with other financial and HR systems, optimizing efficiency and decision-making.

- Learn from Success Stories: Consider case studies like Raj’s Convenience Store to understand the practical benefits of modern systems.

FAQ:

What are the consequences of late processing for small businesses?

- Late processing can lead to dissatisfied employees, decreased morale, potential legal issues, and monetary fines, which can impact the business’s reputation and employee trust.

How can inaccuracies in payroll affect a small business?

- Inaccuracies can result in overpayments or underpayments, leading to financial discrepancies, employee dissatisfaction, potential legal disputes, and penalties for non-compliance with wage laws.

What are the risks of not staying updated with regulations?

- Failing to stay updated with regulations can result in non-compliance, leading to hefty fines, legal challenges, and damage to the business’s credibility and financial health.

How does improper payroll management impact employee morale and retention?

- Improper management can lead to employee frustration, decreased trust in the company, lower morale, and, ultimately, increased turnover, which can affect the business’s stability and growth.

What are the potential legal consequences of mishandling payroll taxes?

- Mishandling taxes can result in audits, penalties, and fines from tax authorities, legal action, and, in severe cases, criminal charges against the business owners or responsible parties.