- Small business payroll mistakes can lead to severe problems like lost employee trust and legal trouble.

- Making your payroll system work smoothly requires careful planning and the right tools.

- Simple changes to your payroll process can improve employee satisfaction and keep your business running strong.

Payroll Management: How to Avoid Mistakes for Small Businesses

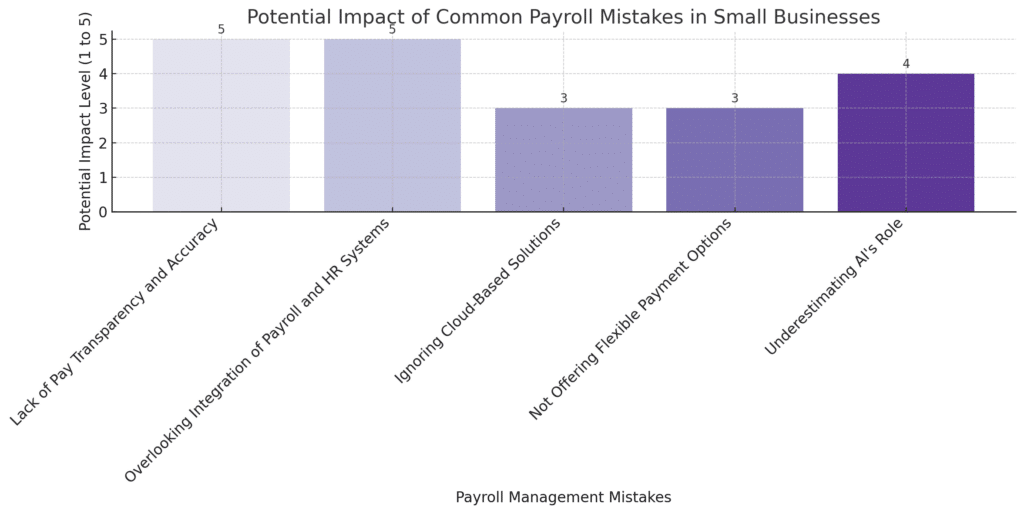

| Common Payroll Mistakes in Small Businesses | Impact on Business |

|---|---|

| Lack of Pay Transparency and Accuracy | Decreased employee trust, potential legal issues |

| Overlooking Integration of Payroll and HR | Inefficiencies, data discrepancies |

| Ignoring Cloud-Based Solutions | Limited flexibility, higher operational costs |

| Not Offering Flexible Payment Options | Reduced employee satisfaction, talent retention issues |

| Underestimating AI in Payroll | Increased errors, non-compliance risks |

Effective payroll management is a cornerstone of success for small businesses. Avoiding common small business payroll mistakes goes beyond ensuring employees are paid on time; it’s about creating a system that fosters trust, compliance, and operational efficiency.

With the evolving landscape of technology and regulations, small business owners face the challenge of adapting to new standards while maintaining accuracy and transparency in their payment processes.

Understanding and avoiding common payroll mistakes is essential in this dynamic environment. It safeguards against legal complications and enhances employee satisfaction and business reputation.

Mistake #1: Lack of Pay Transparency and Accuracy

Pay Transparency’s Role

Pay transparency is crucial for retailers in salary management. It involves clear communication about how pay is determined based on role, experience, and tenure. This openness helps address pay inequality and bias, fostering a trustworthy work environment.

Ensuring Accuracy

Accurate wage management is essential for legal compliance and credibility. Independent retailers are increasingly adopting proactive measures to ensure accuracy. This involves checking payments before they are finalized to prevent errors and involving employees in the review process for greater accuracy and transparency.

Combining Transparency and Accuracy

Integrating pay transparency with payroll accuracy is critical. It’s a strategy that adheres to legal standards and builds employee trust, leading to a more engaged and motivated workforce.

Key Points to Consider:

- Clear communication about how pay is determined.

- Proactive measures for ensuring accuracy.

- Employee involvement in the review process.

Mistake #2: Overlooking the Integration of Payroll and HR Systems

The Importance of Integrated Systems

Integrating HR systems is becoming increasingly important. This integration allows for seamless data management and efficiency, reducing the likelihood of errors and duplications. It ensures that the data is consistent with HR records, enhancing overall business operations.

Benefits of Integration

Integrated payroll and HR systems offer several advantages. They simplify processes, making managing employee data, payroll, and compliance easier. This integration provides a more comprehensive view of employee information, facilitating better decision-making and strategy development.

- Seamless management of employee data.

- Simplification of salary and HR processes.

- Enhanced decision-making and strategic planning.

Mistake #3: Ignoring the Advantages of Cloud-Based Solutions

Shift to Cloud-Based Solutions

Retailers increasingly recognize the advantages of cloud-based solutions. These systems offer accessibility and flexibility, which are crucial for dynamic business environments. With cloud-based solutions, money processing can be managed from anywhere, providing a significant advantage for businesses with remote teams or those who require mobility.

Cost-Effective and Compliant

Cloud-based systems are cost-effective and help maintain compliance with tax laws and regulations. They typically include automatic updates and data backups, ensuring companies stay current with regulatory changes without additional costs or effort.

- Enhanced accessibility and flexibility in processing.

- Cost savings compared to traditional systems.

- Automatic updates for tax compliance and regulatory changes.

Pro Tip: Adopting cloud-based payroll solutions is a strategic move seeking to optimize wage management while ensuring compliance and operational efficiency.

Mistake #4: Not Offering Flexible Payment Options

Diverse Payment Options for Employees

Offering various payment options is becoming essential. This trend includes traditional methods like direct deposit and paper checks and emerging options like cryptocurrency payments. Adapting to these diverse payment preferences can be crucial for attracting and retaining a talented workforce.

The Emergence of Cryptocurrency and Instant Payments

The growing interest in cryptocurrency and the demand for instant payments are reshaping salary processing. Independent retailers should consider accommodating these preferences, as they align with the evolving financial landscape and employee expectations. However, they must also know these payment methods’ regulatory and tax implications.

- Adoption of diverse payment methods, including cryptocurrency.

- Catering to employee preferences for instant payments.

- Awareness of the regulatory and tax implications of emerging payment options.

Mistake #5: Underestimating the Role of Artificial Intelligence

AI’s Increasing Influence

Artificial Intelligence (AI) significantly changes wage processes. AI in payroll systems can streamline operations, ensuring efficiency and accuracy. AI tools can automate repetitive tasks, allowing businesses to focus on more strategic aspects of salary handling.

Automation and Compliance

AI-driven payroll systems are particularly effective in managing compliance with constantly changing regulations. These systems can automatically update to reflect new laws and tax rates, reducing the risk of errors and non-compliance. This feature is especially valuable without dedicated HR or compliance teams.

Key Points to Consider:

- Utilization of AI for efficient processing.

- AI-driven automation of repetitive tasks.

- Enhanced compliance management through AI updates.

How NRS Purple Can Help Avoid Costly Payroll Mistakes

With its focus on small businesses, we provide a comprehensive payroll solution that addresses the common challenges and mistakes that retailers often face.

The platform offers various features specifically designed to streamline processes, ensuring accuracy and compliance, which are crucial.

- Automated Tax Calculations and Compliance: One of our standout features is its ability to automate tax calculations, payments, and compliance. This functionality saves significant time for small business owners and reduces the risk of costly errors and penalties associated with non-compliance.

- Robust Reporting and Analytics: We offer advanced reporting and analytics capabilities. These features provide invaluable insights into labor costs, overtime trends, and productivity, aiding in informed decision-making and strategic planning.

- User-Friendly Software: The platform is designed to be user-friendly, simplifying the entire process from wage calculation to tax filings. This ease of use is particularly beneficial to those who may need more specialized financial staff.

- Customization and Flexibility: We allow small business owners to customize the system to their needs. This includes setting up customized pay rates and schedules that cater to their unique operational rhythms.

- Comprehensive Service and Support: Beyond just software, NRS Purple provides a comprehensive service that handles all wage processing and compliance. This full-service approach means small business owners can focus on core business activities, confident that their payroll is in capable hands.