- Learn the Power of POS Data Analysis: Learn how using sales data can help improve your business.

- Use Data to Grow Your Business: Understand ways to make your business better and more customer-friendly with sales data.

- Make Smart Choices with Sales Info: See data analyzing sales can guide you in making better business decisions.

Introduction: The Power of POS Data Analysis in Modern Business

The business world is evolving rapidly, and data has become its most valuable currency. Among the myriad data types, Point of Sale (POS) data analysis stands out as a key tool for business expansion and operational efficiency. In this digital age, understanding and leveraging POS data can be the difference between thriving and merely surviving in the competitive market.

Understanding POS Data Analysis

POS data analysis examines the data generated at the point of sale, where transactions occur between a customer and a business. This analysis involves dissecting various data types, including sales transactions, customer behavior, inventory levels, and payment methods. The goal is to extract meaningful insights that can drive business decisions.

Types of Data Collected Through POS Systems

| Metric Category | Description | Key Metrics | Example Data |

| Sales Trends | Analysis of sales patterns over time to identify peak periods and trends. | Total sales, Peak times/days, Growth rate | $500K total, 20% growth |

| Customer Behavior | Insights into customer buying habits and preferences. | Average spend, Visit frequency, Preferences | $45 per visit, Bi-weekly visits |

| Inventory Management | Monitoring stock levels and identifying popular and slow-moving items. | Inventory turnover, Stock levels | 5x turnover rate, 200 units in stock |

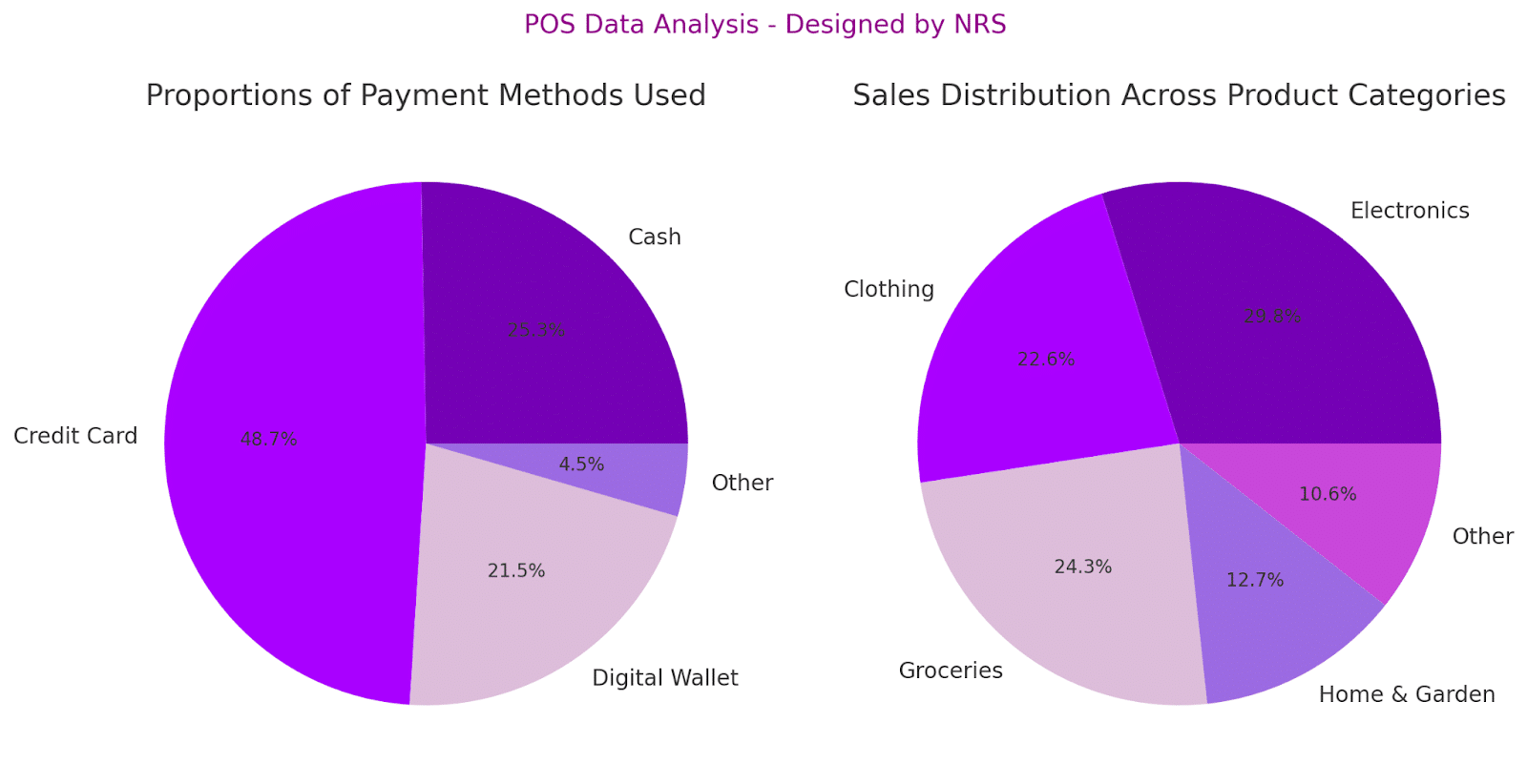

| Payment Methods | Breakdown of different payment types used by customers. | Proportion of cash, cards, digital payments | 30% cash, 60% card, 10% digital |

| Operational Efficiency | Measures of operational effectiveness influenced by POS data. | Transaction time, Checkout efficiency | Avg. 3 min per transaction |

- Transaction Data: Records of Purchases, Including Time, Date, and Item Details

Transaction data is the backbone of point of sale data analysis, providing a comprehensive record of every purchase.

This data is rich in detail, capturing each transaction’s exact time and date and specific item details such as quantity, price, and product type.

By analyzing this data, businesses can identify peak sales periods, track the performance of individual products, and understand purchasing patterns over time.

This information is invaluable for forecasting demand, setting pricing strategies, and planning marketing campaigns.

- Customer Data: Information About Customers’ Buying Habits, Preferences, and Frequency of Visits

Customer data from POS systems offers deep insights into consumers’ buying habits and preferences. This data can include how often customers visit, what products they frequently purchase, and how much they spend per visit.

Analyzing this data allows businesses to create detailed customer profiles, tailor their marketing efforts more effectively, and enhance customer loyalty programs. By understanding customers’ preferences and buying patterns, businesses can personalize the shopping experience, increasing customer satisfaction and retention.

- Inventory Data: Insights Into Stock Levels, Popular Items, and Replenishment Needs

Inventory data from point of sale systems provides critical insights into stock levels, identifying which items are selling quickly and which are not.

This data helps businesses manage their inventory more efficiently, ensuring popular items are always in stock while reducing the overstock of less popular products.

By tracking inventory levels in real-time, businesses can respond promptly to changes in demand, optimize their stock replenishment processes, and minimize the costs associated with excess inventory or stockouts.

- Payment Data: Analysis of Payment Methods, Transaction Times, and Sales Trends

Payment data collected through POS systems includes analysis of various payment methods used by customers, the speed of transactions, and overall sales trends.

This data can reveal customer preferences for specific payment options, such as credit cards, cash, or digital wallets, and can help optimize the checkout process for speed and efficiency.

Understanding payment trends is also essential for financial planning, fraud detection, and developing strategies to encourage higher transaction values and more frequent purchases.

Benefits of Point Of Sale Data Analysis

- Data-Driven Decision Making: Businesses can make informed decisions that reduce waste and optimize resource allocation by analyzing point of sale data. This includes adjusting staffing levels based on customer traffic and managing inventory more effectively to prevent overstocking or shortages.

- Cost Reduction and Increased Agility: The insights from POS data collection lead to direct cost savings by streamlining operations and eliminating inefficiencies. This operational efficiency makes businesses more agile, allowing them to adapt to changing market demands and customer needs quickly.

- Improved Customer Experience: Operational efficiency isn’t just about internal processes; it directly impacts the customer experience. By responding to customer buying patterns and managing inventory intelligently, businesses can ensure customer needs are met promptly and accurately, enhancing overall satisfaction and loyalty.

Key Metrics to Analyze

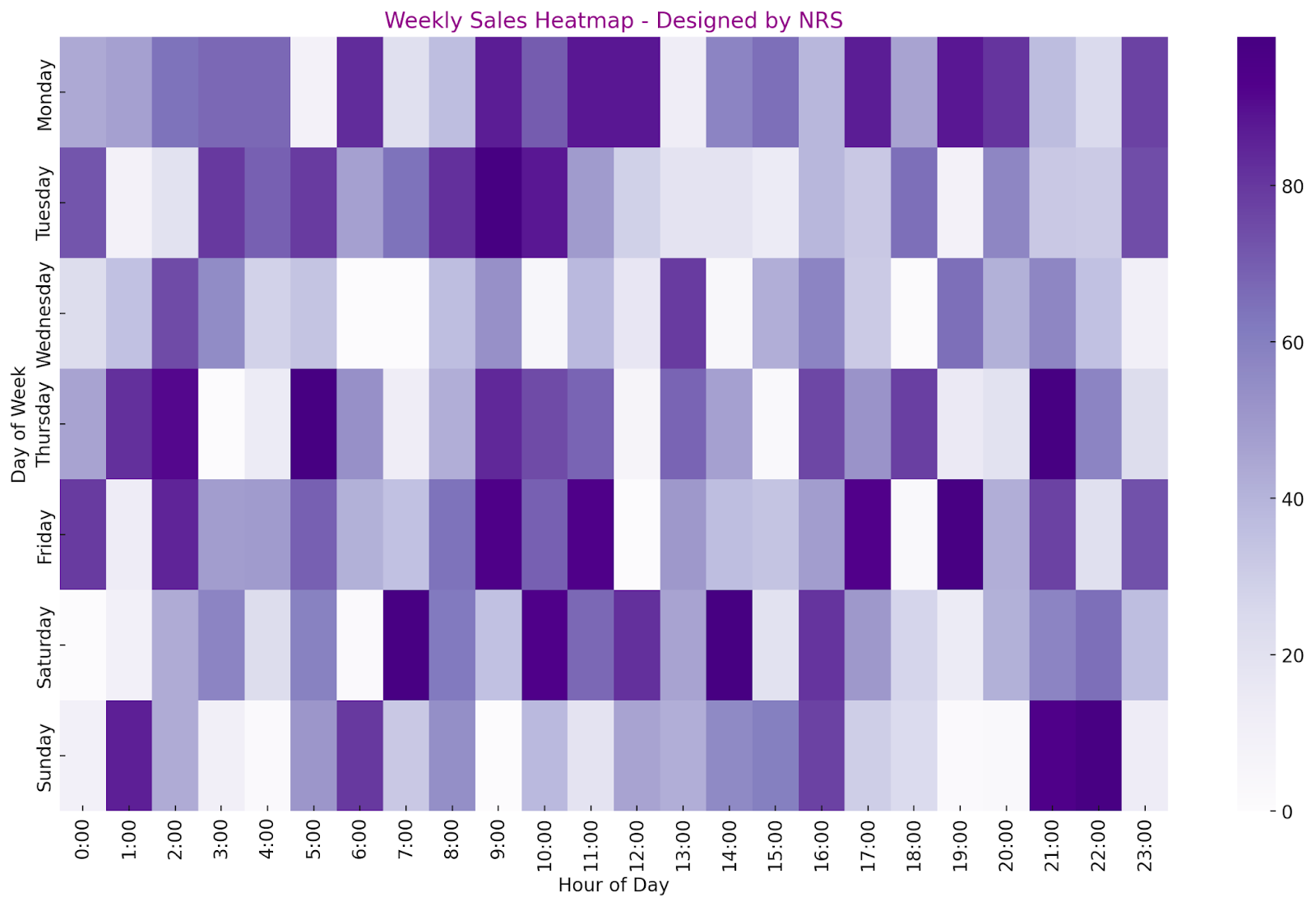

Sales Trends and Inventory Management

Analyzing sales trends is a crucial metric in POS data analysis, as it provides businesses with a clear picture of what products are in demand and when. This information is vital for efficient inventory management.

By tracking which items sell quickly or slowly, businesses can make informed decisions about stock levels, ensuring they have enough of the popular items to meet customer demand while avoiding the unnecessary costs of overstocking less popular products.

Efficient inventory management based on sales trends helps maintain a balanced stock, reducing the risk of stockouts or excess inventory, which can lead to lost sales or wasted resources.

Additionally, understanding seasonal variations in sales trends allows businesses to prepare in advance, ensuring they capitalize on peak selling periods.

Customer Behavior Analysis

Customer behavior analysis is a key metric that offers insights into customers’ purchase history and preferences. This data is invaluable for personalizing marketing efforts and improving customer retention.

By understanding their customer base’s buying patterns and preferences, businesses can tailor their marketing messages, offer personalized promotions, and enhance the shopping experience.

This targeted approach attracts new customers and encourages repeat business, increasing customer loyalty. Furthermore, insights from customer behavior analysis can be instrumental in guiding product development and promotional strategies, ensuring that businesses offer products and services that meet their customers’ evolving needs and desires.

This strategic alignment with customer preferences boosts sales and strengthens the brand’s reputation in the market.

Utilizing POS Data for Business Growth

Strategies for leveraging point of sale data include:

- Identifying New Opportunities: Analyze sales trends to discover potential new markets or product lines.

One of the key strategies for leveraging data for business growth is identifying new opportunities by analyzing sales trends. This analysis can uncover hidden patterns and emerging trends in customer purchasing behavior, signaling the potential for new markets or product lines.

For instance, a sudden increase in demand for a particular type of product could indicate a market shift or an emerging consumer need.

By staying attuned to these trends, businesses can capitalize on these opportunities by expanding their product offerings or entering new markets.

This proactive approach helps maintain a competitive edge and ensures that the business remains relevant and responsive to changing market dynamics.

- Personalization: Use customer data to tailor marketing efforts and improve customer engagement.

Powered by customer data, personalization is another critical strategy for using the data to drive business growth. Businesses can create highly targeted and personalized marketing campaigns by analyzing customer purchase history, preferences, and behavior.

This level of personalization can significantly enhance customer engagement and loyalty. For example, sending customized offers or recommendations based on past purchases can make customers feel valued and understood, leading to increased repeat business and stronger customer relationships.

Personalization also extends to the in-store experience, where businesses can use POS data to offer personalized services or promotions, further enhancing customer satisfaction and loyalty.

- Performance Benchmarking: Compare sales data over time to identify areas for improvement.

Performance benchmarking through comparing sales data over time is essential to foster business growth. This involves analyzing sales figures from different periods to identify trends, patterns, and areas of improvement.

For instance, comparing sales data month-over-month or year-over-year can reveal growth trends, seasonal variances, and the effectiveness of marketing campaigns or new product launches.

This kind of benchmarking helps businesses understand their performance in the context of their historical data, enabling them to set realistic goals and identify improvement areas.

By continuously monitoring and benchmarking performance, businesses can make informed decisions that lead to sustained growth and improved operational efficiency.

FAQ

What is point of sale data analysis? Point of sale data analysis involves examining the data generated at the point of sale to gain insights into sales trends, customer behavior, and operational efficiency.

Why is it important to track POS data? Tracking data is crucial for understanding customer preferences, managing inventory, and making informed business decisions for growth and efficiency.

Which POS data should I monitor? Businesses should monitor data related to sales transactions, customer behavior, inventory levels, and payment methods for comprehensive analysis.