- One of the benefits of using payroll services is that outsourcing to a provider reduces headaches and risk by ensuring accuracy, managing filings, and staying updated on complex regulations.

- Automating tax calculations, payments, and compliance through payroll services saves small businesses significant time and money.

- Robust reporting and analytics offer insights into labor costs, overtime trends, productivity, and other data to inform strategic decisions.

Benefits of Using Payroll Services for Small Businesses: The Backbone of Efficient Operations

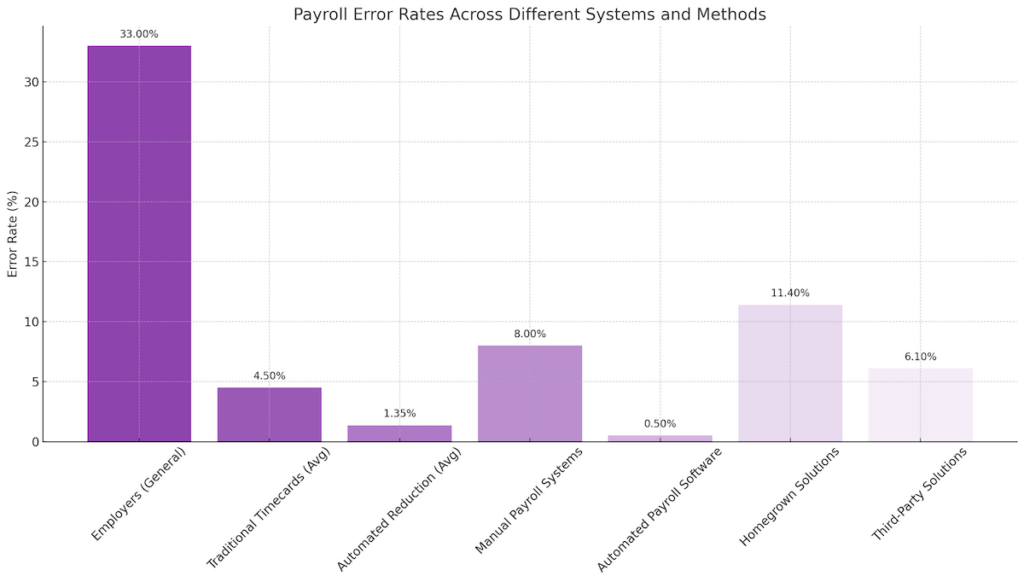

The benefits of using payroll services for small businesses are vital for small businesses as it’s a major expense and crucial for employee satisfaction. Streamlining tasks like wage calculations, paycheck production, payroll tax payments, and year-end tax document generation minimizes errors and costs.

Automation through payroll services saves time and money and reduces mistakes, enables data-driven decisions by offering labor cost insights, and ensures compliance with federal and state laws, averting costly penalties.

This optimization is a cornerstone for operational success, aiding in effective workforce planning, strategy, and legal compliance, thereby significantly benefiting small businesses. One of the benefits of using payroll services is saving time.

What are Payroll Service Providers?

Payroll services handle processing, tax payments, and compliance for other businesses. They aim to simplify and automate the many administrative tasks of paying employees accurately and on time. Leading providers cater specifically to the needs of small and mid-sized businesses.

Robust payroll service solutions offer user-friendly software that streamlines the entire process. This includes calculating wages and deductions, handling direct deposits, and filing required tax documents and payments.

Top providers also offer unlimited pay runs and customization like tailored pay rates and schedules. Reporting functionality provides insights into labor costs and trends.

Add-on services for year-end filings, tax support, and HR compliance ensure a comprehensive solution. Reputable providers also offer responsive customer service, allowing business owners and managers to focus on core operations rather than income administration.

Here are some key features and benefits of using payroll:

- Automated software that calculates gross wages, deductions, bonuses, reimbursements, and net pay based on customizable pay rates, schedules, and locations

- Direct ACH deposit capabilities for fast, secure funds delivery on payday

- Tax payment services that calculate payroll taxes and other withholdings and handle filings and remittance

- Access to an online portal with employee self-service capabilities

- Reporting and analytics for insights into labor costs, overtime, paid time off utilization, and other trends

- Integrations with time and attendance systems, accounting software, and HR platforms to centralize data

- Customization of pay types, schedules, and general ledger mappings according to business needs

- Allowance for unlimited pay runs to support variable pay cycles or special payments

- Year-end services for W-2, 1099, and annual tax form preparation and delivery

- Phone, email, and chat support from knowledgeable customer service teams

- Data security provisions, including encryption, access controls, and audit standards

| Feature | Description |

| Payroll Software | Automates pay calculations, taxes, deductions, paystubs, reporting |

| Direct Deposit | Fast, secure direct deposit of pay to employee bank accounts |

| Tax Payments | Handles tax calculations, payments, filings |

| Online Portal | Employee self-service for payroll management |

| Reporting | Insights into labor costs, overtime, paid time off, and other metrics |

1. Saves Time and Money

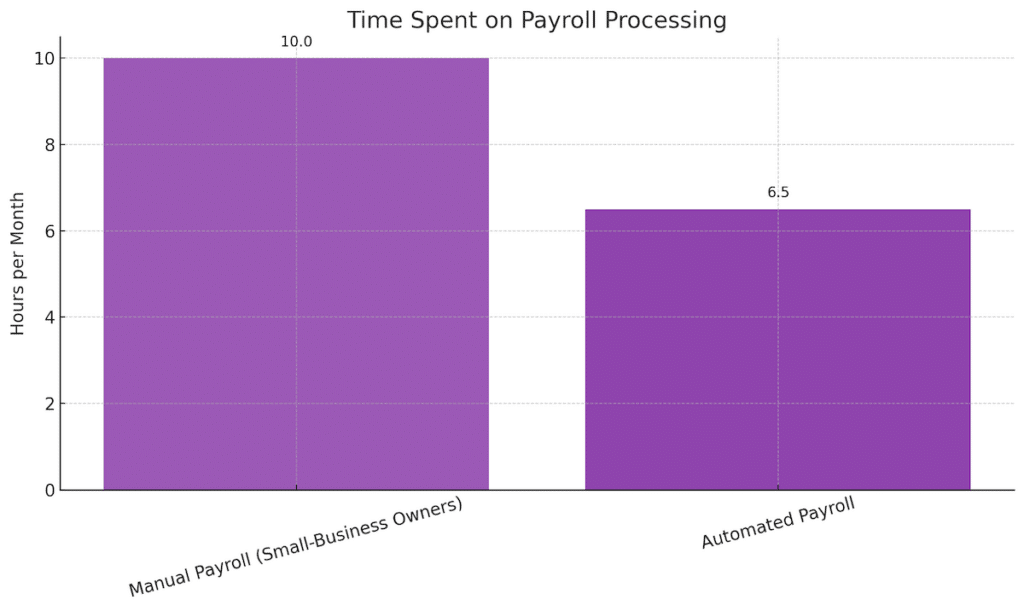

Utilizing a payroll service significantly saves time and money for small businesses. Common salary tasks can eat up 2-5 hours each pay period, diverting focus from revenue-generating activities. With payroll services, the automated system takes care of wage and tax calculations, direct deposits, and tax form filings, following the tax rules set by the IRS and local authorities. This automation frees up crucial hours, enabling owners and employees to focus on sales, operations, and customer growth, potentially generating over $12,000 additional annual revenue on average for the company. Besides, outsourcing payroll tasks can cut down accounting, bookkeeping, and tax preparation fees, making the savings outweigh the service cost.

2. Ensuring Compliance

Compliance with regulations is crucial for small businesses to avoid fines or legal issues. However, only some small business owners have time to research changes in employment laws and tax codes regularly.

That’s where the compliance expertise of the service provider comes in handy. Leading services have dedicated compliance teams that proactively monitor regulatory agencies for upcoming changes.For example, they may determine that new city ordinances require adjustments to local taxes or sick leave accruals. The service provider then immediately updates their software calculations and workflows to align with the new regulations across all client businesses.

Small business owners gain invaluable peace of mind knowing their taxes, reporting, and documents remain compliant through frequent, automated system updates. Relying on a provider to handle compliance also reduces the business’s risk of receiving penalties for errors like:

- Miscalculated taxes or deductions

- Missed tax filing deadlines

- Inaccurate year-end tax documents

3. Enhanced Reporting and Analytics

Payroll services software provides reporting beyond basic wage and tax payment information. Robust analytics and customized reports give business owners valuable insights into labor costs, productivity, and growth opportunities.

For example, small business owners can compare expenses to identify cost spikes associated with seasonal volume changes or new product launches. Finding these trends early allows strategic adjustments to headcount or hours.Owners can also pull reports of overtime hours by the department to determine where excess spending occurs. This visibility empowers managers to control labor budget allocations better.

Advanced reporting goes beyond numbers to drive informed decision-making. With a few clicks, owners can access customizable reports like:

- Employee compensation analysis to determine fair pay rates

- The labor cost percentage of revenue to set profit goals

- Paid time-off utilization to improve culture and coverage

- Overtime and payroll costs by location to optimize operations

Peace of Mind

For small business owners, few tasks provoke more anxiety than processing wages. A manual error could result in missed payments, frustrated employees, tax agency fines, or lawsuits.

Partnering with a provider brings welcomed peace of mind. Leading service providers guarantee accurate calculations and on-time direct deposits. This prevents negative scenarios that hurt employee relations and business reputation.Many providers also offer audits to identify potential issues before filing. If errors occur, they promptly handle corrections and payment of any resulting penalties or fees.

Knowing that an experienced team of income specialists has your back is invaluable. Small business owners can redirect time previously spent stressing over payroll compliance and accuracy.Rather than dreading paydays, they can have confidence direct deposits will clear on time. Employees are paid accurately and reliably via a secure, compliant platform. More focus can remain on core priorities like sales, customers, and product quality.

In summary, working with a reputable provider allows small business owners to breathe easier. They can rely on automation,

| Benefit | Description |

| Time Savings | Automation frees up 5-10 hours per pay period for other tasks |

| Cost Reduction | Low fees compared to staff time spent on manual payroll |

| Compliance | Handles complex regulations, and filings |

| Analytics | Custom reports provide labor cost insights |

| Accuracy | Reduces risk of errors and penalties |

How to Choose the Right Payroll Service Provider for Your Small Business

Choosing the right service provider is key to ensuring your small business payroll process is smooth, compliant, and cost-effective.Your chosen provider becomes your strategic partner, handling sensitive employee pay details, tax obligations, and data security.As such, it’s crucial to thoroughly evaluate potential providers instead of just going with the cheapest or most advertised option.When researching, consider the following key benefits of using payroll services for small businesses:

- Look for a provider with solutions designed specifically for small businesses in your industry.

- Seek automated software that will simplify the processes and ensure accuracy.

- Ensure they handle all tax filings and compliance needs to reduce your workload.

- Consider a provider that offers unlimited pay runs to accommodate your variable schedules.

- Evaluate online access for ease of payroll management.

- Assess whether they offer direct deposit for fast, secure employee payouts.

- Review customization options like tailored pay rates and schedules.

- Verify they handle year-end filings like W2s to fulfill legal requirements.

- Check client reviews and testimonials to evaluate service quality.

Employee Satisfaction and Self-Service

While business owners reap many benefits from payroll services, employees also enjoy an improved experience.Leading providers create a positive payday environment by providing accurate, on-time direct deposits and self-service access.Employees feel informed, appreciated, and engaged when they have transparency and control over their salary details.

When evaluating various platforms, consider the employee experience:

- Accurate and timely pay – Direct deposits processed ensure employees are paid reliably and promptly every pay period. In contrast, manual checks may have delays or errors.

- Self-service portals – Leading providers give employees access to online/mobile self-service portals. Employees can view their pay stubs, tax forms, and leave balances anytime.

- Paystub and tax form access – Portals become a hub for employees to access their paystub details and annual tax documents like W-2s. This is more convenient than digging through old emails or paperwork.

- Leave tracking – Employees can check their up-to-date vacation, sick leave, and PTO balances via the self-service portal. It allows proactive planning for time off.

- Tax changes – Employees can securely update their tax withholding details and view tax information.

- Profile management – Employees can update contact details, bank accounts, and other profile data directly.

Consequences of Non-Compliance

While payroll may seem like a routine back-office function, mishandling it can devastate a small business.

Beyond angering employees by paying them inaccurately or late, poor payout management has far-reaching impacts on operations, finance, legal compliance, reputation, and the owner’s stress levels.

When payroll is manual, late, or error-prone, the risks include:

- Employees do not get paid accurately or on time – This results in highly dissatisfied workers, higher turnover, lawsuits, and employee complaints to labor boards.

- Tax payments need to be included or corrected – This can lead to penalties, interest charges, audits, and legal action by the IRS and state tax authorities for non-compliance.

- Violation of labor laws – Businesses risk fines for minimum wage, overtime, and other compensation violations.

- Loss of trusted reputation – Word spreads quickly, damaging customer and community goodwill toward the business.

- Difficulty recruiting talent – Inconsistent or missed pay makes hiring and retaining good employees much harder.

- Financial instability – Cash flow, profitability, and growth suffer if payroll is mismanaged. It’s a sign of poor business health.

- Lack of insights into labor costs – No data on staff wages, overtime, taxes, etc., to inform budgets and strategy.

- The burden on the owner – Tracking hours, manually calculating pay, printing checks, and filing taxes becomes extremely cumbersome.

- Stress and anxiety – Fear of making costly errors leads to unnecessary pressure and distraction.

Don’t Miss Out on Various Government Assistance Programs

In addition to the many operational headaches improper payroll can cause, non-compliance also means small businesses miss out on various government assistance programs, grants, and contracts.Many federal, state, and local initiatives offer incentives, loans, tax credits, and other benefits based on proper payroll documentation and reporting.Failing to handle payroll correctly restricts access to key programs that foster small business success.Small businesses that don’t prioritize payroll compliance can’t capitalize on opportunities such as:

- Paycheck Protection Program (PPP) – Provides loans to businesses to cover payroll costs and requires documentation of payroll expenses.

- Small Business Administration (SBA) loans – Many SBA loan programs look at payroll and labor costs in assessing eligibility.

- Work Opportunity Tax Credit – Provides tax credits for hiring certain targeted groups based on documented payroll.

- State Unemployment Insurance – Improper payroll reporting can jeopardize eligibility for state unemployment insurance.

- Government Contracting – When bidding on government contracts, proper payroll reporting is required to demonstrate responsible practices.

- Tax Credits – Businesses must accurately report payroll taxes paid to qualify for federal tax credits.

- Family and Medical Leave – Eligibility for programs like FMLA requires proper payroll records and practices.

Conclusion

Switching to a dedicated payroll service tailored for small businesses can be a game-changer.The right provider makes payroll processes fast, stress-free, and compliant. Their software seamlessly automates calculations, filings, taxes, and direct deposits based on customizable settings for each business.Robust cloud-based access enables payroll management from anywhere.A reputable payroll service will understand your variable employee schedules, OT needs, and busy seasons.Seek a provider whose accuracy guarantees and knowledgeable customer support provides peace of mind. Payroll may seem like just another chore, but the right service transforms it into an invaluable business asset.With an experienced payroll provider, small businesses can save time, reduce headaches, and focus on growth.Get started today and reap the benefits of using payroll services.

FAQ

Q: What do payroll services do?

A: Payroll services calculate pay, handle tax payments and filings, process direct deposits, and manage compliance tasks for employers.

Q: What are the main benefits of using a payroll service?

A: It saves time, ensures compliance, provides helpful analytics, increases employee satisfaction through accuracy and self-service, and gives peace of mind.

Q: How do payroll services help with tax compliance?

A: Providers stay up-to-date on tax laws, automatically calculate taxes and deductions, handle filings and payments, and correct any errors.

Q: What reporting is available from payroll services?

A: Custom reports provide insights into labor costs, overtime, compensation, paid time off utilization, and other metrics and trends.

Q: How can employees access their paystubs?

A: Self-service employee portals allow access to pay stubs, tax documents, leave balances, and tools to update details.

Q: What questions should I ask when selecting a service provider?

A: Key considerations include services offered, pricing, software features, integrations, customer support quality, security protections, and provider reputation.

Q: How do I switch payroll providers?

A: Research new payroll providers specializing in your retail niche, like gas stations, convenience stores, liquor, and tobacco stores. Look for customer testimonials. Compare their rates, software, feature sets, integrations, and customer service with your current provider.