| Key Takeaways | Impact on Customers |

|---|---|

| EMV chip technology reduces fraud by up to 80% | Increased protection against card skimming |

| Contactless payments cut transaction time by 50% | Faster, more convenient fueling experience |

| Mobile payment options enhance security and speed | Greater flexibility in payment methods |

| Biometric authentication on the horizon | Next-level security for future transactions |

Imagine pulling up to a gas pump, swiping your card, and driving away – only to find out later that your financial information has been compromised.

This scenario is all too real for many customers, with gas stations being prime targets for payment fraud. But what if filling up your tank could be more secure and more convenient than ever?

Welcome to the new era of gas station payment systems, where cutting-edge security meets unparalleled customer convenience.

The Current State of Gas Station Payment Systems

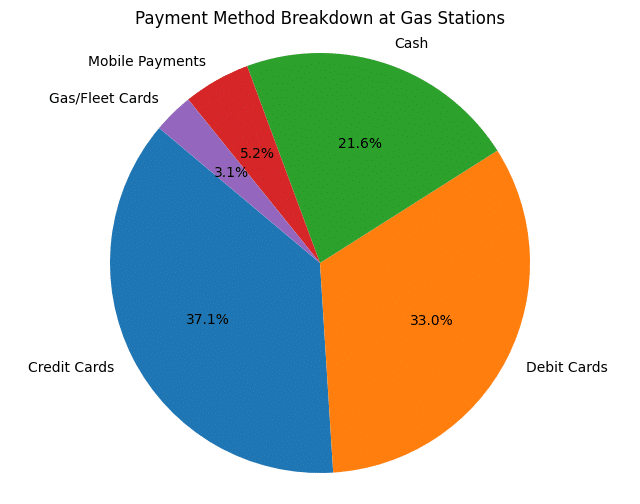

Swipe, insert, tap, or cash? Your choices at the pump go far beyond just filling your tank. Gas station payment systems today represent a mix of traditional methods and emerging technologies.

This blend creates a unique environment where familiar practices coexist with innovative solutions. Each approach offers distinct benefits and challenges, influencing customer experiences and business operations alike.

Traditional Payment Methods

Gas stations currently offer several payment options, including:

- Cash

- Credit cards

- Debit cards

- Fleet cards

- Prepaid cards

While these methods are familiar to customers, they come with varying degrees of security and convenience.

Common Security Risks

Unfortunately, gas stations have become hotspots for payment fraud. Here are some of the most prevalent security risks:

- Card skimming: Criminals install devices on card readers to steal card information.

- Data breaches: Hackers target gas station networks to access customer data.

- Pump tampering: Fraudsters manipulate fuel dispensers to steal card details.

- Employee theft: Dishonest staff may misuse customer payment information.

These risks threaten customers’ financial security and erode trust in gas stations. As a result, both customers and gas station owners are seeking more secure and convenient payment solutions.

Enhancing Gas Station Payment Security: A Win for Customer Convenience

To combat the security risks associated with traditional payment methods, gas stations are implementing cutting-edge technologies designed to protect both customers and businesses.

EMV Chip Technology

EMV (Europay, Mastercard, and Visa) chip technology has become the gold standard for secure card payments:

- Creates unique transaction codes for each purchase

- It makes card data duplication extremely difficult

- Reduces fraud by up to 80% compared to magnetic stripe cards

Contactless Payments

Contactless payment options offer both security and speed:

- Utilizes Near-Field Communication (NFC) technology

- Often involves additional security layers like tokenization

- Cuts transaction time by up to 50%

Mobile Payment Options

Smartphone-based payment systems add another layer of security:

- Incorporates biometric authentication (e.g., fingerprint or facial recognition)

- It uses device-specific tokens instead of actual card numbers

- Allows for quick, secure transactions without physical cards

Benefits of Enhanced Payment Security for Customers

The implementation of these advanced security measures brings numerous advantages to gas station customers:

- Reduced Fraud Risk

- Lower chance of falling victim to card skimming

- Protection against data breaches and unauthorized transactions

- Faster Transactions

- Quicker payment processing, especially with contactless options

- Less time spent at the pump, improving overall convenience

- Improved Peace of Mind

- Confidence in the security of financial information

- Reduced stress associated with potential fraud

- Greater Payment Flexibility

- Multiple secure payment options to choose from

- Ability to use preferred payment method without compromising security

Implementing Secure and Convenient Payment Solutions

For gas station owners looking to enhance their payment security and customer experience, consider the following steps:

Upgrading Point-of-Sale Systems

- Invest in PCI-compliant systems

- Implement point-to-point encryption (P2PE)

- Install tamper-resistant hardware with security seals and alarms

Training Staff on Security Protocols

- Educate employees on identifying suspicious activity

- Establish procedures for handling suspected fraud

- Ensure proper handling of sensitive card data

Educating Customers About New Payment Options

- Provide clear instructions for using new payment technologies

- Highlight the security benefits of advanced payment methods

- Offer incentives for using more secure payment options

Additional Security Measures

- Install and maintain surveillance systems

- Implement transaction monitoring to flag unusual activity

- Conduct regular anti-skimming inspections on gas pumps and outdoor terminals

- Integrate a POS-integrated panic alarm button. The panic alarm button lets employees discreetly alert authorities in emergencies, ensuring staff safety and quick response times.

- Integrate your POS system with video surveillance. Overlay POS transactions in real time onto your store’s DVR footage. This provides valuable evidence in cases of disputes, theft, or fraud, helping you identify perpetrators and resolve incidents quickly.

By prioritizing payment security, gas stations can create a safer environment for their customers while protecting their own financial well-being and reputation. These measures combat fraud and enhance the overall customer experience, leading to increased trust and loyalty.

The Importance of Modern POS Systems for Gas Stations and Convenience Stores

Gas stations and convenience stores need a modern point of sale (POS) system. These systems go beyond simply processing payments and offer a robust suite of features that enhance security, streamline operations, and improve the overall customer experience.

Modern point of sale systems empower gas stations and convenience stores to:

- Enhance Security: EMV chip technology encrypts sensitive card data, making it significantly more difficult for fraudsters to steal and misuse customer information.

- Reduce Fraud: Modern POS systems drastically lower the risk of fraudulent transactions by utilizing advanced security measures, potentially saving businesses substantial amounts of money and protecting their reputation.

- Improve Customer Experience: With faster transaction processing and intuitive interfaces, POS systems help create a smoother, more efficient checkout process, minimizing wait times and enhancing customer satisfaction.

- Ensure Regulatory Compliance: Staying current with the latest payment industry standards is crucial. A comprehensive POS systems help businesses adhere to regulations, avoiding potential fines and penalties.

- Streamline Inventory Management: Modern POS systems can track inventory levels in real-time, helping businesses avoid stockouts and optimize ordering. This can lead to cost savings and increased profitability.

- Enhance Employee Productivity: User-friendly interfaces and automated tasks can help employees work more efficiently and effectively, improving customer service and reducing labor costs.

- Gain Valuable Insights: Modern POS systems can collect and analyze sales, inventory, and customer behavior data. This valuable information can be used to make informed business decisions, such as optimizing pricing, promotions, and marketing campaigns.

In addition to the benefits listed above, modern POS systems can also offer a number of other advantages, such as:

- Improved employee morale: A user-friendly POS system can make it easier for employees to learn and use, increasing job satisfaction and reducing turnover.

- Enhanced marketing capabilities: Some POS systems offer integrated marketing tools to help businesses reach new customers and promote their products and services.

- Reduced paper clutter: Modern POS systems can help businesses go paperless, saving money and reducing environmental impact.

As you can see, modern POS systems offer various benefits for gas stations and convenience stores. A modern POS system is a wise investment if you’re looking to improve your business operations, enhance security, and provide a better customer experience.

NRS Petro:

NRS Petro is a leading provider of POS systems for gas stations and convenience stores. Our systems are easy to use, integrate with gas pumps, and are EMV compliant. NRS Petro also offers a variety of other features and services to help businesses succeed, such as:

- Inventory management

- Customer loyalty programs

- Marketing tools

- Technical support

If you’re looking for a modern POS system to help you take your gas station or convenience store to the next level, contact NRS Petro today.