- Understanding the importance: A well-rounded knowledge of financial and credit card fraud training for employees and other types of money scams.

- Steps to get it done: Laying out the steps to create a strong credit card fraud training program that fits different businesses’ needs.

- Keep learning: Ensuring employees know the latest financial and credit card fraud prevention methods.

In today’s digital age, businesses face an ever-evolving landscape of financial threats. Among these, credit card scam is a persistent challenge, with criminals employing increasingly sophisticated techniques.

However, the broader spectrum of financial deception also poses significant risks, encompassing everything from embezzlement to cyber con.

To safeguard against these threats, it’s imperative for businesses to invest in comprehensive financial and credit card fraud training for employees.

Such training not only equips employees with the knowledge to recognize and combat fraud but also fosters a culture of vigilance and integrity.

By getting the big picture of financial deceit and what it can do, businesses can be better prepared to avoid money problems and harm to their reputation.

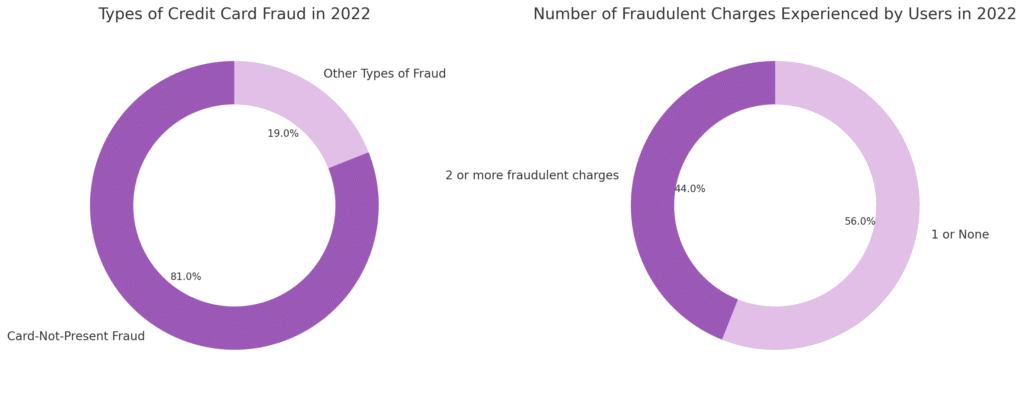

Types of credit card fraud in 2022. Illustration by NRS

The Role of Employees in Credit Card and Financial Fraud Training and Prevention

Financial and credit card fraud training for employees is key. Workers can spot scams first. This training helps them see and stop these scams, keeping our money and details safe. A trained team also makes your business trusted by customers:Frontline Detection:

- Employees act as the first line of defense against credit card and financial con.

- Often first to notice discrepancies or unusual activities in the workplace or customer interactions.

Training and Equipping:

- Equipping employees with knowledge and tools for recognizing and reporting the scam is essential.

- Training helps in identifying red flags like suspicious transactions or inconsistent customer information.

Effective Response:

- Training enables employees to respond effectively to suspected scams, safeguarding company assets and customer information.

Business Reputation:

- A well-trained staff fosters a secure, trustworthy environment.

- Enhances business reputation and boosts customer confidence.

The Importance of POS Systems in Credit Card Fraud Training for Employees

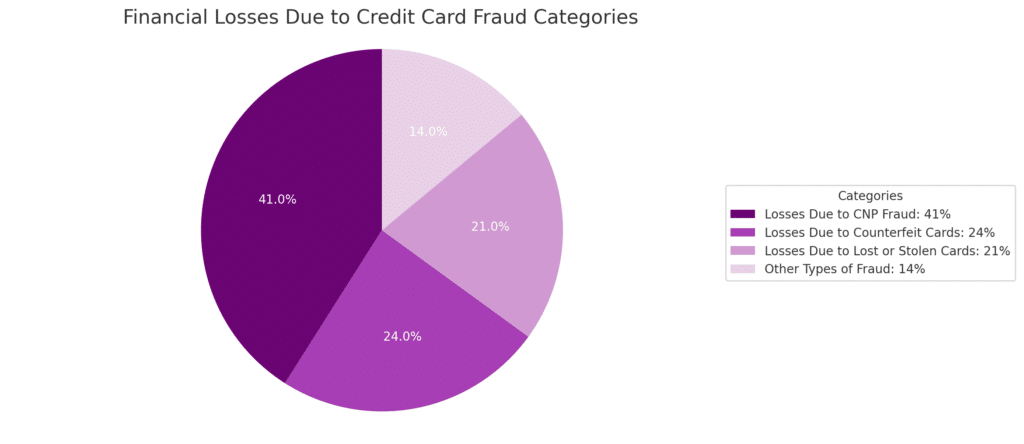

Losses due to different categories. Illustration by NRS

Advanced Encryption:

- NRS POS systems come equipped with top-tier encryption protocols. This ensures that every transaction is secure and that sensitive customer data is shielded from potential threats.

Real-time Monitoring:

- With real-time transaction monitoring, any unusual activity can be flagged immediately. This proactive approach helps in early detection of potential fraud

Integrated Payment Solutions:

- By offering integrated payment solutions, NRS ensures that all payment methods, whether card-based or digital, are processed securely, minimizing the risk of credit card and financial fraud.

Regular Software Updates:

- To stay ahead of evolving threats, NRS regularly updates its POS software. This ensures that the system is always equipped with the latest security measures.

Employee Training Modules:

- Recognizing the importance of human vigilance, NRS offers training modules to educate employees about potential fraud signs and the correct protocols to follow.

Real-world Examples of financial and credit card fraud

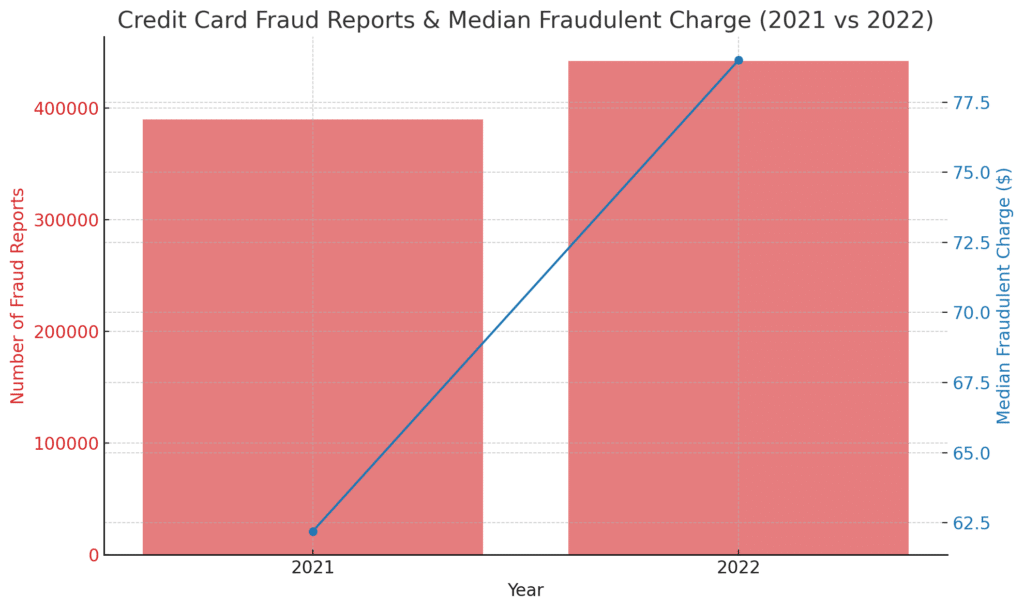

Fraud reports are increasing yearly. Illustration by NRS

Dozens of angry consumers took to social media to warn others of the scam happening at certain South Bay grocery stores.

In this case, criminals were using skimmers to grab debit and credit card information from the grocery store card scanners. They would then use this stolen information to make unauthorized purchases, potentially wiping out victims’ bank accounts in a matter of hours.

This example highlights the importance of taking proactive measures to combat credit card hoaxes for businesses and consumers.

Grocery stores and other retailers should invest in security measures to detect and prevent skimming devices, such as regularly inspecting payment terminals for tampering and using chip-enabled card readers.

On the other hand, consumers can protect themselves by using credit cards with fraud protection, monitoring their accounts for suspicious activity, and considering using cash or alternative payment methods for added security when shopping at high-risk locations like grocery stores.

Skimming Prevention and Security Measures

For Retailers:

- Investment in security measures is crucial to detect and prevent skimming devices.

- Regular inspection of payment terminals for tampering.

- Adoption of chip-enabled card readers for enhanced security.

For Consumers:

- Usage of credit cards with fraud protection to safeguard against skimming.

- Regular monitoring of accounts for any suspicious activity.

- Consider cash or alternative payment methods for added security, especially at high-risk locations like grocery stores.

Implementing a Fraud Training Program

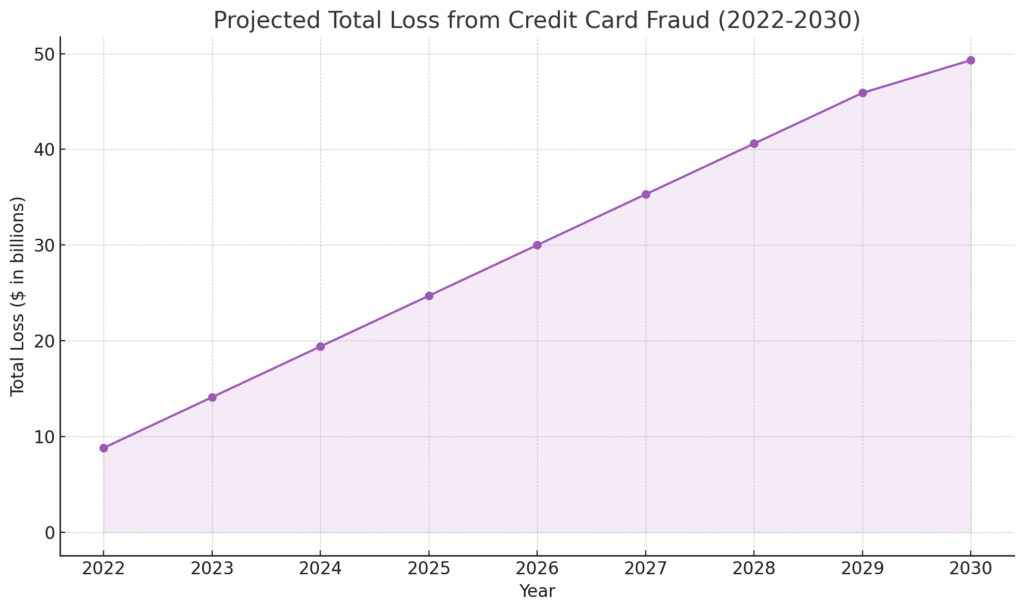

Projected financial loss 2022 – 2023. Illustration by NRS

It’s about fostering a culture of integrity, where employees are educated on ethical behavior and can identify and report fraudulent activities.

Through this training, the understanding and vigilance of employees are enhanced, making them a crucial part of the business’s defense against fraud.

Core Components of Financial and Credit Card Fraud Training for Employees

A successful fraud training program for employees should encompass the following core components:- Awareness: Educate employees on the different types of scams and how they can manifest in the workplace.

- Detection: Train employees on recognizing the signs of fraudulent card activities and the proper channels for reporting them.

- Prevention: Discuss the procedures and controls that can be put in place to prevent fraud.

- Response: Outline the steps to be taken when card con is detected, including investigative processes and legal procedures.

Continuous Training and Monitoring

Fraud prevention is an ongoing effort. Continuous training and monitoring are crucial to ensure employees remain vigilant and updated on the latest credit card scam risks and prevention techniques.Methods of Training

Diversifying the methods of training can enhance engagement and retention. Consider incorporating:- Digital Training Modules: Interactive online courses that employees can complete independently.

- Live Training Sessions: In-person sessions led by prevention and detection experts.

- Interactive Workshops: Hands-on workshops where employees can apply what they’ve learned in practical scenarios.

Evaluating the Effectiveness of The Training Program

Ensuring the training program effectively equips employees with the necessary knowledge and skills is vital. An effective evaluation process can provide valuable insights into the strengths and weaknesses of the program, allowing for continuous improvement.Feedback Mechanisms

Gathering feedback from employees can provide invaluable insights into the effectiveness of the training program. Consider implementing:- Surveys: Collect feedback through anonymous surveys to gauge employees’ overall understanding and satisfaction.

- Interviews: Conduct one-on-one interviews to delve deeper into individual experiences and understanding.

- Focus Groups: Organize focus group discussions to stimulate dialogue and gather diverse perspectives on the training content and delivery.

Analyzing Training Data

- Evaluate employee engagement and comprehension using quizzes, tests, and interactive sessions.

- Analyze data from assessments to identify areas of improvement.

- Tailor future training sessions to better meet the workforce’s needs.

- Ensure effective communication and understanding of crucial fraud detection and prevention information.

- Adopt an iterative process: analyze training data, adjust the program, and re-evaluate.

- Establish a continuous improvement cycle to enhance the training program’s efficacy.

- Build a robust shield against financial misconduct through enhanced training.

Real-world Impact

It’s important to check how well the training program works in real life. We can look at two things to know if it’s working well:- Are there fewer credit card fraud or financial fraud cases?

- And are more people telling us when they see something like credit card fraud happening?

Encouraging a Culture of Integrity and Transparency

Beyond training, fostering a culture of integrity and transparency is fundamental to preventing credit card schemes and financial fraud.Promoting Open Communication

Leadership’s Role

Continuous Improvement

In conclusion, financial and credit card fraud training for employees is a crucial step toward protecting your business from potential financial misconduct.

It not only equips employees with the necessary knowledge and skills but also fosters a culture of integrity and transparency.

Continuous evaluation and improvement of the employee training program, coupled with strong leadership and open communication, can significantly contribute to creating a safer and more ethical work environment.

By proactively preventing credit card fraud, businesses and retailers can mitigate risks and create a trustworthy and secure environment for employees and customers.