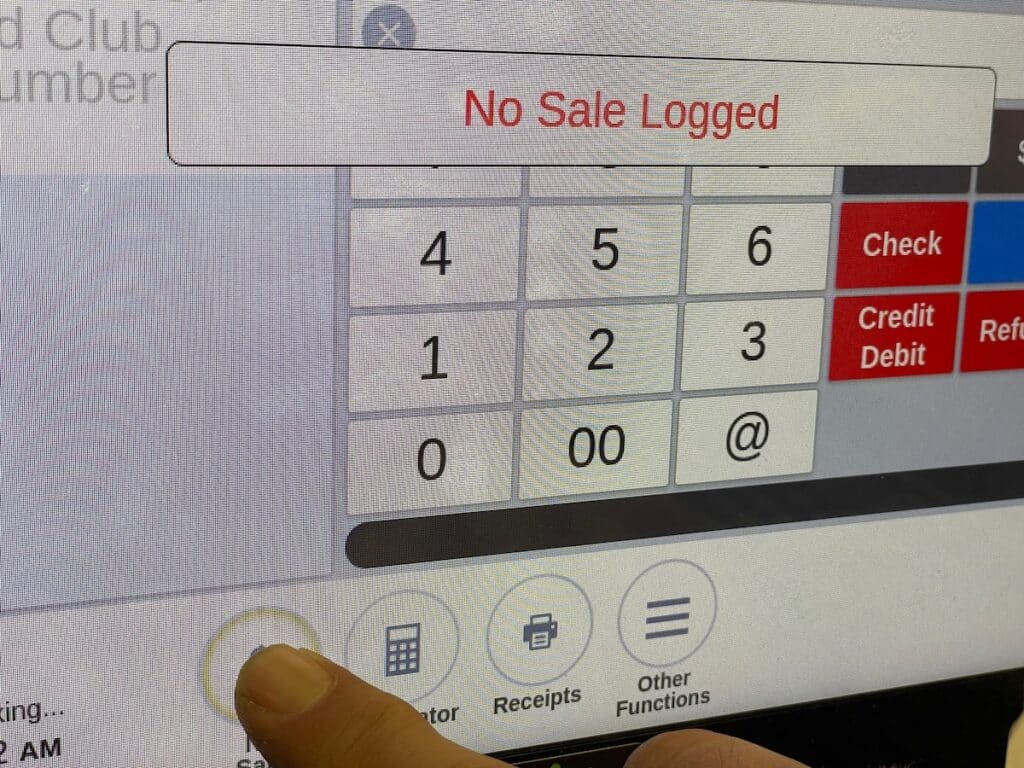

There are two ways for Mom-and-Pop shops to go about transferring data from a credit card during a sale. One is through a POS system and the other an independent payment terminal. The difference between the two is how the data is captured, in an all-in-one POS system or a multiple-device POS system. Point of Sale (POS) systems provided by National Retail Solutions (NRS) include separate pieces used for transactions: the POS terminal and a credit card reader. Other POS companies provide payment terminals built into their POS system, a one-stop in which all transactions are done in the same place. While some merchants prefer the relative ease of a combined POS with payment terminal, where data flows immediately within the transaction, there is good reason to consider an NRS POS system as a worthwhile, long-term investment. NRS Pay credit card processing conducted on its own card reader and connected with the NRS POS is much less susceptible to data breaches than all-in-one payment terminals. If all of a customer’s data is stored in a single payment terminal, the information can fall into criminal hands if a data breach occurs. Though large-scale data hacks at major companies make the news, it can also happen at small businesses. So while customers may not be surprised if their data is usurped from a bank or chain store, they will be shocked to learn of such an occurrence at their local grocery, liquor or hardware store – and likely not to return. As the leading national provider of POS systems to independently owned bodegas, groceries, hardware stores, and liquor and tobacco establishments, NRS has a superb reputation for offering forward-thinking POS solutions in a variety of categories, including helping clients ward off the hijacking of their customers’ sensitive data. By separating credit card transactions through both the POS terminal and credit card reader, the NRS POS system doesn’t store sensitive information in one place and therefore doesn’t run the risk of leaving vital customer information exposed. Though adding an extra step in the transaction process through separate devices could be more costly than a one-step payment terminal, merchants should consider thinking in the long-term. Small business owners may not be wise to take the chance that their customers’ data won’t be breached, thinking data hackers only care about large corporations. But, as discussed earlier, that may not be the case. An unprepared small business may be easier for the bad guys to prey upon since they won’t have to worry about high-tech, anti-hacking software installed by the big players. Some hackers may see small businesses as a good way to practice their illegal skills before moving on to bigger companies. The ROI of a POS payment system is immediate. Knowing that POS operations are safe, gives peace of mind to merchants and customers alike. Especially when the Mom-and-Pop shop down the street falls victim to a data breach and their customers disappear – perhaps to start patronizing your shop. NRS is a nationwide leader in providing POS software and hardware plus integrated or standalone NRS Pay credit card processing to mom-and-pop shops with approachable costs and many premium benefits. Known for its integrity, honesty and transparency, NRS is dedicated to its clients’ success in all facets of running a small business.