- To know how to plan your business finances, utilize point of sale integration to streamline financial data management.

- Select a system that aligns with your budgeting and scalability needs.

- Leverage transaction data for accurate financial forecasting.

- Combine your system with accounting software to save time and improve accuracy.

Planning your business finances effectively is essential for any business aiming for stability and growth. A clear financial strategy helps manage cash flow and supports long-term objectives. Integrating POS financing solutions into your plan can give you a clear edge, especially when tracking income and expenses efficiently.

Why Planning Your Business Finances Is Essential for Your Business

Financial planning is the backbone of any business, ensuring that resources are allocated effectively. By establishing a solid financial foundation, businesses can:

- Manage cash flow more efficiently

- Forecast growth and plan for future needs

- Track expenses to avoid unnecessary spending

Incorporating POS financing into your financial strategy can provide valuable data insights, enabling you to stay ahead in budgeting and expense management.

Understanding the Role of POS Systems in Financial Planning

A Point of Sale (POS) system is much more than a simple checkout tool. Modern systems are equipped with features designed to support and simplify financial management.

Point of sale systems help businesses go beyond basic sales transactions, offering essential tools for tracking revenue, managing inventory, and generating financial reports that can inform business decisions and long-term strategies.

With real-time capture and organization of sales and inventory data, these systems empower business owners to gain clear insights into their cash flow and profitability. This makes financial planning easier and more accurate, enabling business owners to respond quickly to changes in customer behavior or market conditions.

Here’s how these systems contribute to financial planning in key ways:

Sales Tracking and Revenue Management:

POS systems track every transaction, providing a clear sales record. This allows for detailed revenue analysis, helping you understand which products or services drive the most income.

Inventory Management:

Effective POS systems include inventory management features that track stock levels, update quantities after each sale, and alert you to reorder when inventory is low. Keeping a tight handle on inventory helps prevent overstocking and stockouts, both of which can have financial implications.

Financial Reporting and Data Insights:

With built-in reporting tools, a POS system provides financial statements, sales summaries, and performance metrics that assist in budgeting and forecasting.

The reports can be tailored to different time periods or specific product categories, offering a comprehensive view of business performance and supporting data-driven decision-making.

Expense Control

A POS system enables businesses to track and categorize expenses associated with each transaction. Capturing these costs in detail helps manage and control spending across categories like product sourcing, staffing, and promotional activities.

Incorporating this system into your financial strategy offers a reliable foundation for managing day-to-day finances while preparing for long-term growth. The centralized data it provides keeps financial planning organized, efficient, and informed, setting businesses up for greater financial stability and success.

What is a POS System?

A Point of Sale (POS) system is a comprehensive solution that combines hardware and software and is designed to handle much more than basic transactions. At its core, this system processes payments and collects and organizes valuable sales and customer data. This enables businesses to analyze their performance accurately and efficiently, supporting daily operations and strategic planning.

Implementing point of sale integration provides a seamless connection between business functions, such as inventory management, sales tracking, and customer relationship management (CRM).

This integration allows for streamlined data flow, where each transaction is recorded in real time and reflected across various systems. The result? Businesses gain accurate records, reduce manual data entry, and accelerate financial processes, all critical for effective financial planning.

Here’s how the hardware and software components work together to support a business’s operations and financial goals:

Hardware

A POS system typically includes physical devices such as card readers, receipt printers, barcode scanners, and cash drawers. These elements work together to create a smooth checkout experience, ensuring that every sale is accurately recorded and transactions are processed efficiently.

Software

The software side captures, organizes, and analyzes sales and customer data, providing detailed insights into sales trends, customer buying patterns, and inventory levels. Using POS financing solutions integrated with the software, businesses can set up customized payment options, monitor outstanding invoices, and manage revenue flow directly within the system.

Through these integrated hardware and software functions, the system enables businesses to:

- Ensure data accuracy: Automated sales tracking means fewer errors in financial records, allowing for more precise budgeting and planning.

- Save time: Integrated financing and reporting features reduce time spent on manual data entry and streamline financial reconciliation.

- Enhance decision-making: With access to real-time sales data, business owners can make informed financial decisions quickly, adapt to changes in demand, and improve overall profitability.

Financial Benefits of POS Systems

| Feature | Description |

| Inventory Management | Tracks stock levels, provides real-time updates, and alerts for reordering. |

| Sales Tracking | Records and organizes sales data to help identify trends and peak times. |

| Customer Loyalty Program | Offers built-in programs to boost customer retention and repeat sales. |

| Financial Reporting | Generates detailed reports for budgeting and revenue forecasting. |

| Accounting Integration | Enables seamless data flow to accounting software, reducing errors and saving time. |

A POS system delivers measurable financial advantages that help businesses streamline operations and manage resources more effectively. One key benefit is its ability to provide real-time sales data, which gives business owners a clear picture of revenue as it flows in.

This instant access to sales information allows for immediate insights, helping businesses respond to trends and make timely adjustments to meet demand. The result is more efficient cash flow management and reduced financial risk, as every transaction is accurately recorded and accessible for review.

Another advantage is that a POS system automates critical tasks like inventory management. A POS system helps avoid the costly issues of overstocking or stockouts by tracking inventory levels and updating them with each sale.

Businesses can monitor stock quickly, set reorder alerts, and maintain optimal stock levels. This reduces the financial waste associated with excess inventory and prevents potential lost sales due to out-of-stock items. Additionally, with robust financial reporting capabilities, a POS system makes it easier to set budgets, forecast revenue, and identify areas for improvement in spending and stock management.

- Real-time sales tracking to monitor revenue

- Automated inventory management to reduce stockouts and overstocking

- Detailed financial reporting for budgeting and forecasting

Budgeting for a POS System

Budgeting is essential when planning for a point of sale system, as it ensures that the system meets both immediate needs and long-term financial goals.

Investing in this technology involves evaluating the initial costs, such as purchasing hardware and software, as well as factoring in ongoing expenses like maintenance, support, and any necessary software upgrades.

Additionally, point of sale financing options may be available to help manage these upfront expenses, making it easier to allocate resources strategically.

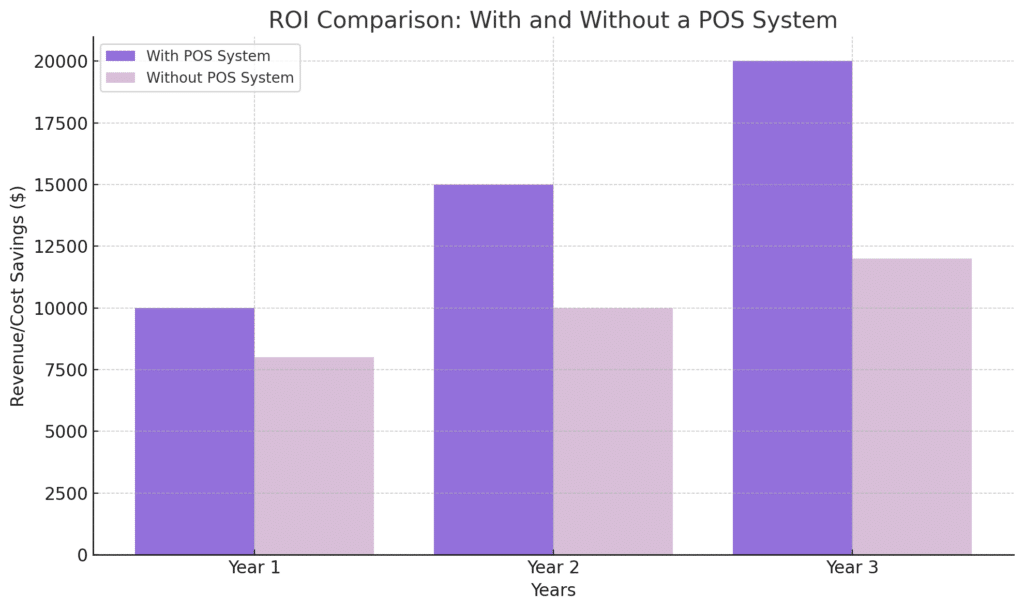

It’s also important to consider the potential return on investment (ROI) that a well-chosen system can provide—whether through streamlined operations, enhanced sales tracking, or improved inventory management.

Proper budgeting helps ensure your system supports your financial strategy without straining resources.

- Initial costs of hardware and software

- Ongoing expenses for maintenance and support

- Potential ROI from improved financial management

How to Choose POS System Based on Your Financial Goals

Choosing a POS system that aligns with your business’s financial goals involves understanding how each feature supports immediate needs and long-term growth.

National Retail Solutions (NRS) offers a comprehensive POS designed specifically for independent retailers, including convenience stores, grocery stores, and gas station convenience stores.

Focusing on practical, scalable features, NRS makes managing transactions easier, tracking inventory, and enhancing customer service easier:

- Assess Your Business Needs: NRS provides a user-friendly POS with powerful software tools for sales tracking, inventory management, and customer loyalty. Designed for high-volume, independent stores, the NRS POS system includes merchant and customer-facing screens, a mobile app for remote access, and specialized features like Tobacco Scan Data and ID Scanning for compliance. This setup is ideal for retailers who want robust tools without sacrificing simplicity.

- Consider Scalability: As your business grows, you’ll need a POS system to handle increased transaction volumes and additional service options. NRS POS offers customizable features, including eCommerce integration and NRS Petro solutions for gas stations, enabling seamless growth in operations.

- Evaluate ROI: NRS’s POS system is designed to support cost savings with competitive pricing, starting at $19.95 monthly. With NRS Pay integrated for affordable credit card processing and NRS Funding available for quick cash advances, this system is a cost-effective choice that drives value by reducing operational costs and offering resources for expansion.

Selecting a scalable and comprehensive POS system like NRS can align your financial goals with reliable, cost-effective technology supporting current operations and future growth.

Using POS Data to Enhance Financial Planning

Leveraging POS data allows businesses to gain valuable insights into sales trends, peak hours, and customer buying habits, all essential for informed financial planning. The data-driven approach enables businesses to allocate resources effectively, optimize inventory, and forecast demand more accurately, ultimately supporting smarter budgeting and revenue growth strategies.

- Identify peak sales periods to optimize staffing and inventory.

- Analyze customer preferences to tailor product offerings and promotions.

- Track sales trends to make accurate revenue forecasts and budget allocations.

Integrating your POS system with accounting software

Integrating your POS system with accounting software streamlines record-keeping and financial reporting, creating a seamless data flow between sales and accounting. It reduces the risk of errors, eliminates the need for manual data entry, and saves valuable time, allowing business owners to focus on more strategic financial planning.

- Automate financial record updates to reduce manual entry and errors.

- Consolidate sales and expense data for more comprehensive financial reports.

- Improve accuracy in budgeting and forecasting with real-time financial data.

Preparing for the Future: Scaling Your POS System as Your Business Grows

As your business grows, your point of sale system must keep pace with increased demands and evolving requirements.

A scalable system allows you to handle higher transaction volumes and access features that adapt to your business’s changing needs, ensuring that your financial operations remain smooth and efficient during expansion.

- Support higher transaction volumes as sales increase.

- Access advanced features to match growing business needs.

- Adapt seamlessly to new locations or additional sales channels.

Ready to take control of your business finances? With National Retail Solutions (NRS), you’ll have the tools and support to streamline operations, track sales, and optimize your financial planning. From advanced POS systems to seamless integrations and flexible financing, NRS empowers your business every step of the way. Start planning for success with NRS today!